MASSACHUSETTS INSTITUTE OF TECHNOLOGY

Introducing the MIT Dual-Use Readiness Levels™

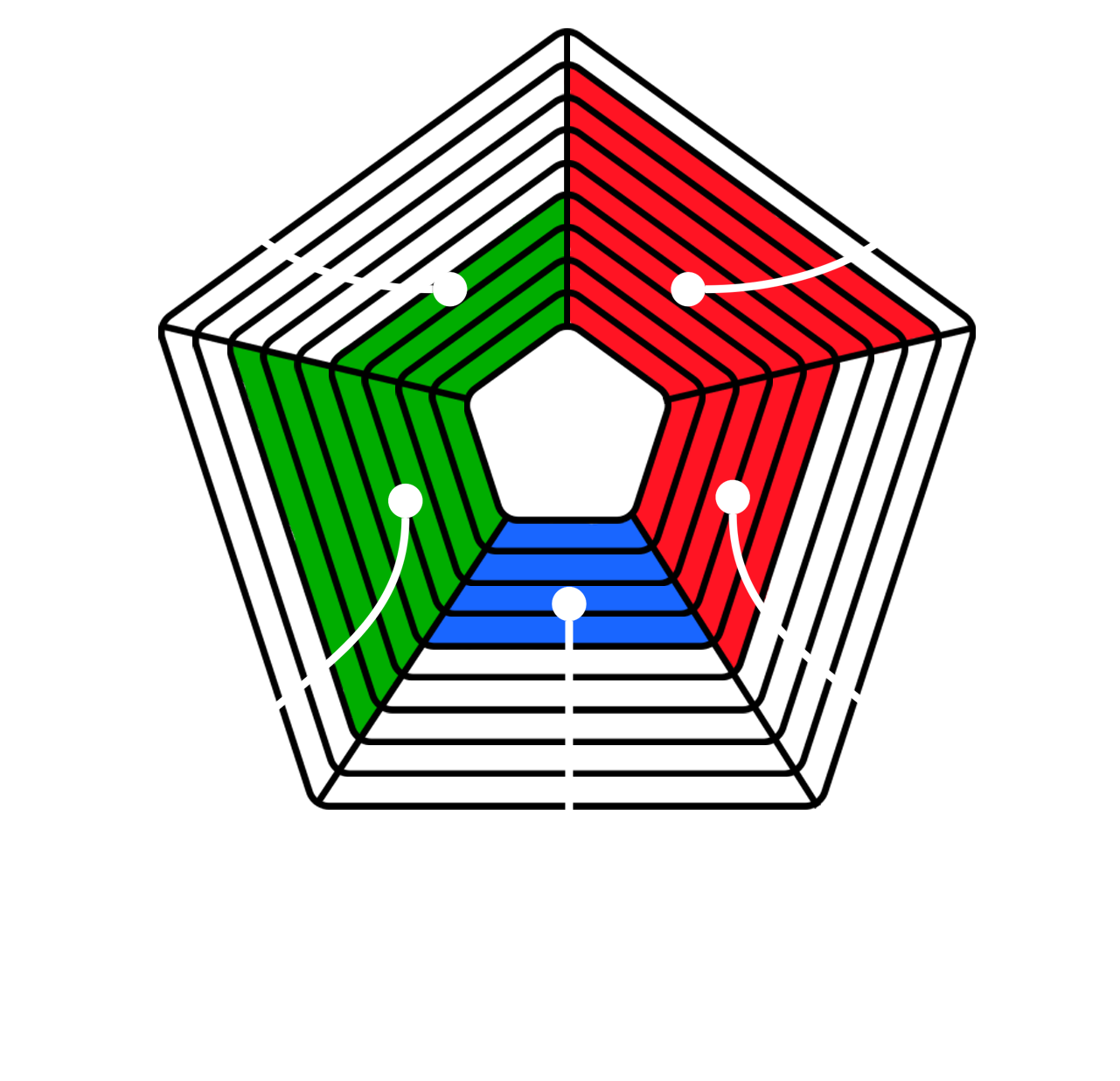

MIT’s Dual-Use Readiness Levels™ guide early-stage startups in dual-use strategy, fostering communication between commercial and mission-driven sectors. This model includes three readiness pathways—commercial, mission, and technology. It integrates startup models while addressing gaps between commercial and mission customers and funding, enabling startups to strategically assess their readiness across different dimensions.

Featured Story

Dual-Use Is a Strategy, Not a Category (Nor a Trap)

Instead of playing with category boundaries, for venture teams and their investors, dual-use must be understood as a strategy that shapes plans and priorities and emphasizes ethical adoption in all use cases.

MIT Dual-Use Readiness Levels™

Commercial Funding Readiness Level (CFRL)

This level assesses a startup's progress in securing and managing commercial or dilutive investments. It focuses on evaluating how well the startup is positioned to attract and utilize venture capital, angel investments, and other forms of commercial funding. Startups need to understand how to navigate the complexities of securing funding while balancing the potential dilution of equity ownership in their company.

CFRL 1Exploring potential funding avenues, including bootstrapping and pre-seed funding. |

The startup is identifying potential avenues for funding, exploring whether to bootstrap or pursue pre-seed investment to take the initial steps in its business journey. At this level, the focus is on market research and developing the business concept. | Example: Imaginary Co. is developing a concept for an eco-friendly packaging solution and is researching local angel investors and making a list of “family and friends” for initial funding while refining its business plan. |

CFRL 2Actively seeking pre-seed or angel investors for initial milestones |

The startup is actively seeking early financial backers such as pre-seed or angel investors to support achieving key early milestones such as minimal viable prototype (MVP) development. This level shows a move from concept to initial action and actual fundraising. | Example: TechWidget Inc. has a prototype for a wearable health monitor and is pitching to angel investor networks to fund its market validation study. |

CFRL 3Pre-seed or angel funding secured to continue market exploration |

With pre-seed or angel funding secured, the startup is actively engaged in market exploration and beginning product development. This early injection of funds is used to validate assumptions and prepare for further financial rounds. | Example: BioExplore LLC has secured angel funding to develop its first laboratory-based prototype for rapid disease detection and is conducting initial market assessments. |

CFRL 4Seed funding being pursued for initial product development and market validation |

The startup is in the process of pursuing seed funding, which is essential for product development and initial market validation efforts. At this point, the company aims to demonstrate the viability of its product to attract further investment. | Example: GreenDwell Homes is seeking seed investment to build sustainable tiny home models and validate the market through a pilot project in three cities. |

CFRL 5Seed funding round completed; positioning for future funding with defined milestones and growth objectives |

Having completed a seed funding round, the startup is working on achieving predefined milestones and growth objectives to pave the way for larger investments. There is an operational product and initial market traction at this level. | Example: EduTech Solutions has completed its seed funding round and is focused on increasing its user base and proving its educational software’s efficacy to attract Series A funding. |

CFRL 6Series A funding being actively targeted to scale operations and market presence |

The startup targets Series A funding to scale its operations and expand its market presence. Successful reaching of Series A would reflect market validation and investor confidence in the business model. | Example: VirtualEvents Platform is targeting Series A funding to expand its online event hosting capabilities and grow its customer base internationally. |

CFRL 7Series A funding secured; planning for Series B to further scale and possibly enter new markets |

The startup plans for Series B funding after securing Series A, which means it's preparing to scale up further, improve existing products, and possibly explore new markets. This reflects a level of success and stability where the business has proven its model and is ready for aggressive growth. | Example: CloudSecure Inc. has leveraged its Series A to gain a foothold in the cybersecurity market and is preparing a Series B round to finance expansion into new regions and develop additional security services. |

CFRL 8Series B (or later stages) funding secured; continuous assessment of future funding needs |

With Series B funding secured, the startup enters a phase of accelerated growth, focusing on scaling its business operations and assessing ongoing funding requirements. It represents a mature startup with a significant customer base, driving towards becoming a market leader. | Example: DataAI, a machine learning analytics firm, after closing its Series B, is scaling its operations and enhancing its technology stack to meet the growing demand for big data solutions in the healthcare sector. |

CFRL 9Scaling, market expansion and strategic investment with a focus on exit |

The startup is in an advanced growth phase with potential market leadership, possibly exploring strategic investments, mergers, and acquisitions, or even preparing for public listing. At this stage, the startup is a well-established player with a sustainable, scalable business. | Example: GreenMobility, an electric vehicle sharing service, is expanding globally and exploring strategic partnerships or an IPO as it becomes a dominant player in the urban mobility sector. |

Commercial Customer Readiness Level (CCRL)

The Commercial Customer Readiness Level measures how effectively a startup is engaging, capturing, and selling to commercial customers. This includes evaluating the startup's market strategy, sales and marketing capabilities, and ability to address the needs of commercial clients. Success at this level is crucial for startups aiming to establish a strong presence and revenue stream in the commercial market.

CCRL 1Initial assumptions about general market needs |

The startup is forming initial assumptions about general market needs, beginning to conceptualize where its product or service could fit within a broader market. This stage involves high-level market analysis, often leading to a preliminary business model. |

Example: Imaginary Co. is assessing the demand for eco-friendly packaging materials across various industries, intending to identify market gaps and customer preferences. |

CCRL 2Identification of specific market requirements |

At this stage, the startup identifies specific requirements of the market, structuring its product development to meet these needs. Tailoring the offering to meet market demands becomes a priority. |

Example: TechWidget Inc. has conducted a survey to understand specific health monitoring needs and features that consumers desire in a wearable device, and is analyzing these insights to inform its product development plans. |

CCRL 3Initial feedback from the market obtained |

The startup is gathering initial feedback from the market, engaging in early conversations with potential customers to refine its product offering. This feedback loop helps to adjust the product development to better suit market demands. |

Example: BioExplore LLC is presenting its disease detection prototype at trade shows and medical conferences, collecting feedback from practitioners to enhance its relevance and usability. |

CCRL 4Validation of the market opportunity by multiple customers |

The startup secures validation from multiple potential customers, establishing that there is a market opportunity for its product. This validation is often critical for moving towards the development of a marketable product or service. |

Example: GreenDwell Homes is showcasing its eco-home concepts at sustainable living expos and has received positive feedback from multiple real estate developers interested in green construction. |

CCRL 5Confirmed interest from a beachhead market and established connections to potential customers |

Confirmed interest from a beachhead market has been established, with the startup making significant connections with potential customers. This level signifies a more focused and deliberate approach to entering the market. |

Example: EduTech Solutions has received endorsements from several school districts for its educational software after successful pilot programs demonstrating improved student engagement. |

CCRL 6Product's value verified through partnerships or initial customer trials |

The startup's product value has been verified through partnerships or initial customer trials, confirming that the offering has genuine traction in the market. This stage often leads to fine-tuning product-market fit and preparing for a broader roll-out. |

Example: VirtualEvents Platform has partnered with two major conference organizers for virtual event hosting, validating its platform's capabilities and user experience. |

CCRL 7Customers engaging in comprehensive product trials or initial purchase tests |

The startup's product is being adopted by early customers through comprehensive trials or initial purchase tests. These engagements are critical for understanding product performance in real-world scenarios and can lead to iterative product enhancements. |

Example: DataAI is experiencing its first wave of product purchases by healthcare providers and is now expanding its sales force to capitalize on its growing reputation in the big data analytics sector. |

CCRL 8First products purchased with escalating business development and sales |

At this level, the startup enjoys extensive and scalable product sales, indicating a successful market penetration and the establishment of a robust customer base. This is often the phase where processes and supply chains are optimized for wide-scale distribution. |

Example: DataAI is experiencing its first wave of product purchases by healthcare providers and is now expanding its sales force to capitalize on its growing reputation in the big data analytics sector. |

CCRL 9Extensive and scalable product sales |

The startup is in an advanced growth phase with potential market leadership, possibly exploring strategic investments, mergers, and acquisitions, or even preparing for public listing. At this stage, the startup is a well-established player with a sustainable, scalable business. |

Example: GreenMobility has widespread adoption of its electric vehicle sharing platform, with scalable sales across major cities, and is implementing enhancements to its app to support global user demand. |

Mission Funding Readiness Level (MFRL)

Assessing a startup's ability and progress in capturing non-dilutive sources of funding, such as government contracts or grants, falls under the Mission Funding Readiness Level. Startups need to strategically pursue government funding opportunities and understand the unique requirements and processes associated with securing grants and contracts to support their mission-driven initiatives.

MFRL 1Exploring a dual-use funding strategy |

The startup is exploring a dual-use strategy, where it considers opportunities for its technology in both commercial and mission-driven applications. This phase involves researching possible mission partnerships and funding sources like government grants or contracts. | Example: Imaginary Co., while focusing on eco-friendly packaging solutions for commercial use, is also investigating defense applications for lightweight, durable materials and potential government funding for R&D. |

MFRL 2Identification of first phase funding sources, such as innovation grants or R&D programs |

Identification of funding sources for initial phase projects is underway, such as innovation grants or R&D programs, to support the startup's mission-related product or technology development. | Example: TechWidget Inc. is identifying government and private grant programs that could finance further development of its health monitoring wearable for use in remote patient monitoring for military personnel. |

MFRL 3Application(s) submitted to secure first phase funding and mission partnership opportunities |

The startup has applied to secure first-phase funding and is actively seeking partnerships with mission-focused organizations to support and guide its product development for mission use. | Example: BioExplore LLC has submitted proposals for government grants to further its rapid disease detection technology for bio-surveillance missions and is seeking partnerships with public health agencies. |

MFRL 4Award(s) of first phase non-dilutive funding from mission-driven organizations |

The startup has been awarded its first phase of non-dilutive funding from mission-driven organizations, marking a transition from the planning to execution phase in its mission strategy. | Example: GreenDwell Homes has received an innovation grant for the development of sustainable living modules that can be used for rapid deployment in disaster relief missions. |

MFRL 5Continued dual-use strategy while securing procurement relationships with funded mission partners |

The startup continues its dual-use strategy, securing procurement relationships with funded mission partners. This level involves more in-depth collaboration to align the product with mission requirements. | Example: EduTech Solutions is working closely with education-focused NGOs to deploy its software in underserved regions, aligning with both commercial objectives and educational missions. |

MFRL 6Application(s) submitted for follow-on grant or award phases; at least one deep partnership with mission user |

After submitting applications for follow-on grant or award phases, the startup has at least one deep partnership with a mission user. This stage confirms the potential fit of the startup's product within mission-driven programs. | Example: VirtualEvents Platform is applying for additional funding to enhance its platform for training simulations for emergency response teams after establishing a key partnership with a national disaster response organization. |

MFRL 7Award(s) of follow-on phases of funding and progress in securing enduring pathways into mission production |

The startup has secured follow-on phases of funding, demonstrating progress in establishing enduring pathways into mission production, which can lead to a viable long-term contract or integration into mission programs. | Example: CloudSecure Inc. has advanced to the next phase of funding for its cybersecurity solutions after proving its value in pilot programs with a government agency, moving towards becoming a regular part of the agency's security infrastructure. |

MFRL 8Substantial investment from late-phase mission procurement partner for continued development |

The startup has received significant investment from late-phase mission procurement partners for continued development. This investment helps in fine-tuning the product for mission-specific needs and paves the way for formal adoption. |

Example: DataAI has secured a substantial contract from a defense contractor for its analytics platform, to be tailored for intelligence gathering and analysis, marking a critical step towards integration into national defense systems. |

MFRL 9Long-term funding secured through production contracts or integration into the mission budget |

With long-term funding secured through production contracts or integration into the mission budget, the startup's product becomes part of the standard issue or sees widespread deployment across multiple units or platforms within the mission context. |

Example: GreenMobility's electric vehicle sharing technology has been adapted and integrated into military bases around the country for efficient, on-demand transportation, backed by a multi-year contract with the Department of Defense. |

Mission Customer Readiness Level (MCRL)

The Mission Customer Readiness Level indicates the startup's success in forming relationships and formally working with specific mission-driven or government customers. Building strong partnerships with government agencies, defense organizations, and entities prioritizing national security or public safety is essential for startups focusing on the mission-driven market.

MCRL 1Initial awareness of mission stakeholders; potential for dual-use identified |

The startup is just beginning to gain awareness among mission stakeholders, understanding the potential dual-use of its product or technology in mission applications alongside commercial use. Initiating outreach to potential mission-focused clients is key at this level. | Example: Imaginary Co. is seeking to engage with environmental agencies to see if their eco-friendly packaging solutions can be used in mission-critical applications, such as disaster relief efforts where sustainable materials are valued. |

MCRL 2Preliminary assessments of utility determined; business development resources applied to mission context |

The startup has carried out preliminary assessments of how their product or service could be beneficial in a mission context, getting ready to apply business development resources towards these opportunities. | Example: TechWidget Inc. is exploring how its wearable health devices could be adapted for military use, conducting initial assessments to understand the specific needs of soldiers in field operations. |

MCRL 3Formal meetings and engagements with end users and sponsors; focusing in on capability use cases |

Formal meetings and engagements with potential end-users and sponsors help the startup refine its understanding of mission-specific use cases, evolving their product design and features to address unique mission requirements. | Example: BioExplore LLC is engaging in formal meetings with government health agencies to refine its disease detection technology based on specific use cases and operational requirements of national health missions. |

MCRL 4Alignment of capability with specific mission needs; identification of potential modifications needed |

The startup's product or technology has been recognized for alignment with specific mission needs, but may require modifications. Attention is now focusing on how to adapt their solution for the mission environment. | Example: GreenDwell Homes is working with non-governmental organizations in disaster zones to determine how their sustainable housing can meet the unique demands of rapid-deployment shelters. |

MCRL 5Collaboration on refining the capability; mission input on design, features, and operational integration |

Collaboration with mission users has intensified to refine the capability of the product, incorporating mission input into design, features, and operation. This usually entails collaborative development with input from the mission side to ensure suitability. | Example: EduTech Solutions is collaborating with international educational missions to ensure their software meets the diverse needs of global classrooms, especially in regions with limited resources. |

MCRL 6Commitment from mission stakeholders; letters of intent or preliminary agreements indicating serious interest |

Commitment from mission stakeholders has been obtained, with letters of intent or preliminary agreements indicating serious interest. The startup's product is progressing towards an integrated solution for the mission organization. | Example: VirtualEvents Platform has received letters of intent from several emergency response organizations interested in utilizing its platform for training and simulation purposes. |

MCRL 7Evaluations and validation of the capability fit within mission |

Evaluations and validations of the startup's product within various missions have been successful, showing the capability fits well within the mission aims. This level of readiness escalates the potential for formal adoption as the product or service is considered for integration into mission systems or operations. | Example: CloudSecure Inc. is in the final stages of product validation with a national security agency, proving that their cybersecurity tools meet the rigorous standards required for mission-critical systems. |

MCRL 8Formal adoption of the capability; integration into mission systems, training, or doctrine |

The startup's technology or service has formally been adopted; it's now being integrated into mission systems, training, or doctrine. This stage represents a significant milestone as the product becomes an official part of the mission's operational toolkit. | Example: DataAI's analytics platform has been integrated into a defense intelligence system, contributing to data-driven mission planning and operation after formal adoption by the defense department. |

MCRL 9Standard issue or widespread deployment across multiple units or platforms |

The product has become standard issue or is seeing widespread deployment across multiple units or platforms, becoming a common tool within the mission's operational environment. It signifies full-scale acceptance and integration of the product in the mission context. | Example: GreenMobility has achieved a major success with its electric vehicles being adopted as the standard transportation option at numerous military installations, enhancing operational efficiency and supporting the mission's sustainability objectives. |

Technology Readiness Level (TRL)

The concept of Technology Readiness Levels has been around for a long time and is very well understood in the context of assessing the development stage of a company's technology, so will not be covered in detail here. According to the European Space Agency, TRLs provide a standard way of measuring the maturity of a technology, with TRL 1 representing the lowest level of technology readiness and TRL 9 indicating that the technology is fully qualified, has been proven in an operational environment, and is ready for commercialization.